The authors of the book Ending Parkinson's Disease have a campaign at www.endingpd.org to get the U.S. to ban chemicals (like the de-greaser TCE) linked to the rising rates of Parkinson's Disease in US. These doctors are asking us to write the head of the EPA and President Biden to ask them to specifically ban Trichloroethylene (TCE), Paraquat (an agricultural chemical), and Chlorpyrifos, as well as ask for a needed increase in Parkinson's research funding, since rates of the disease keep rising (and these dangerous toxins persist in the air, water, and soil). Will we do something now to perhaps save the youngest generation from getting poisoned? And what are all these chemical toxins doing to the other species, like the wildlife, with whom we share the planet?

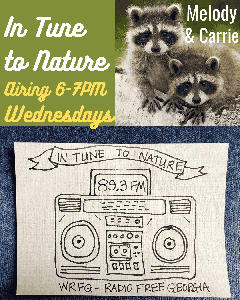

"In Tune to Nature" host Carrie Freeman introduces the subject and her personal connection to it and then plays part of an endingpd.org 2020 webcast interview on the risks of the de-greasing solvent TCE (talking to a toxicology researcher and a lawyer with Parkinson's who is an advocate for change). https://www.youtube.com/watch?v=mqYpE5wEPJE

30 minute Podcast. Broadcast on July 14, 2021 on Radio Free Georgia on 89.3FM www.wrfg.org (a nonprofit, noncommercial progressive radio station that relies upon donations).