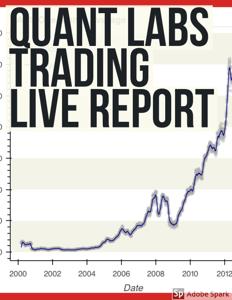

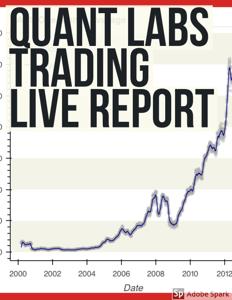

I am still on a mission with non correlated asset allocation. i test 2 optimal assets from 2 days vs oday. What is the difference between expect volatility, returns, and Sharp ratio? Watch this video to see if it makes a difference. Do you still need to apply dollar coat averaging to this?

Boost your trading account with our newsletter https://quantlabs.net/contact/

https://quant-labs.net/2022/02/04/non-corelated-assets-proves-to-win-even-without-usa-stock-market/

View all episodes

View all episodes

By QuantLabs.net

By QuantLabs.net