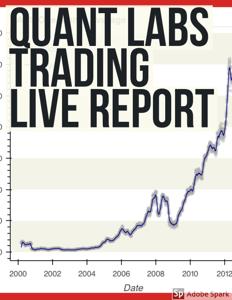

Welcome to a comprehensive episode where Brian from FontLabsNet.com delves into a series of insightful articles focusing on strategy, development, and allocation in the financial markets. This episode covers key topics such as macroeconomic analysis, technical indicators, and the efficacy of simple momentum strategies.

LEARN | Quantlabs (quantlabsnet.com)

Dive into Effective Trading Algorithms and Simple Momentum Strategies (quantlabsnet.com)

In the first segment, we explore an article from PriceActionLab.com that highlights the use of simple technical indicators for tracking market momentum. Brian discusses how a 12-month moving average model has shown promising results, even outperforming more complex strategies in certain scenarios.

The episode continues with a critical examination of why macroeconomic market analysts often dismiss other methods, particularly systematic trading. Brian shares his own experiences and insights, emphasizing the importance of both fundamental and technical analysis for market timing and selection.

Next, we shift focus to a DIY trend-following asset allocation strategy from AlphaArchitect.com. Brian outlines the current exposure recommendations for various asset classes, including domestic and international equities, REITs, commodities, and bonds. He provides guidance on how to balance these allocations based on different risk profiles.

The episode wraps up with a deep dive into mathematical modeling and spread calculations, featuring discussions from Quant.StackExchange.com. Brian addresses complex questions on modeling bid and ask processes and calculating spreads for trading strategies, offering practical advice for managing market noise and volatility.

Tune in for a wealth of knowledge on market strategies, backed by real-world examples and expert analysis. Don't miss out on this informative episode that promises to enhance your understanding of market dynamics and trading methodologies.