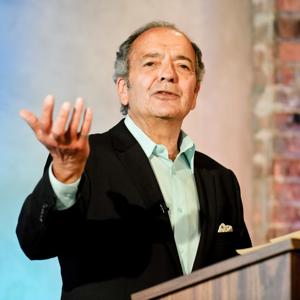

Jack comments on today’s US job creation numbers for April, which show a

significant decline in new jobs created, to 160,000, compared to

previous months. Some problems with how jobs are calculated are

explained, including how new business creations, missing labor force,

and the US labor department surveys often fail to account for jobs

accurately or timely changes. Recent wage gains articles in the

mainstream press are then challenged as well. Jack explains the

differences in wages as a share of national income, total compensation,

average hourly earnings, and average hourly wages all have their limits

as indications of how American workers are actually doing in terms of

take home pay after inflation. Economic Policy Institute studies show

median worker real earnings in the US have been declining every year

since 2010. Gains in wages have been skewed to the top 10%, pulling up

‘averages’ which are not an accurate indicator of wage income declines

for the US working class. The show concludes with a review of global

economic developments, including growing splits among economic elites in

Europe and in Japan, as their economies continue to languish despite QE

and negative rates. And how China continues to struggle with bringing

its shadow banks and speculators under control.

View all episodes

View all episodes

By Progressive Radio Network

By Progressive Radio Network