Sign up to save your podcasts

Or

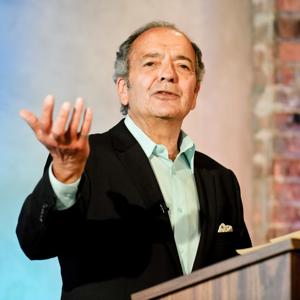

Dr. Rasmus discusses emerging evidence of how the Trump tax cuts are being spent by investors and businesses. As predicted, the 10%-31% bottom line profits windfall from the tax cuts are going to stock buybacks, dividend payouts and mergers & acquisitions. Buybacks and dividends are projected to reach $1.3 trillion in 2018, higher than the previous 7 yr. average of $1 trillion a year. M&A activity will increase from $1.2 trillion in 2017 to $2.0 trillion. Evidence that the much-hyped global synchronous recovery last year is also now dissipating is discussed. Forecasts by JPM and Citi banks are a slowing growth in the global economy in 2018 compared to 2017. Europe, Asian, and commodities data confirm. Weak spots in US economy—retail sales, auto sales, jobs, Fed rate hikes, yield curve, and US household debt ($2.5 trillion rise in 3 yrs) and wages—are considered as well. The IMF recent report that the global economy debt pile is $164 trillion, and 225% of global GDP, now concentrated in nonfinancial corporations and governments. Rasmus explains how the ‘dual track’ Trump trade war (real for China and phony for US allies) will further impact US deficits, debt, and the economy.

View all episodes

View all episodes

By Progressive Radio Network

By Progressive Radio Network

4.8

2525 ratings

Dr. Rasmus discusses emerging evidence of how the Trump tax cuts are being spent by investors and businesses. As predicted, the 10%-31% bottom line profits windfall from the tax cuts are going to stock buybacks, dividend payouts and mergers & acquisitions. Buybacks and dividends are projected to reach $1.3 trillion in 2018, higher than the previous 7 yr. average of $1 trillion a year. M&A activity will increase from $1.2 trillion in 2017 to $2.0 trillion. Evidence that the much-hyped global synchronous recovery last year is also now dissipating is discussed. Forecasts by JPM and Citi banks are a slowing growth in the global economy in 2018 compared to 2017. Europe, Asian, and commodities data confirm. Weak spots in US economy—retail sales, auto sales, jobs, Fed rate hikes, yield curve, and US household debt ($2.5 trillion rise in 3 yrs) and wages—are considered as well. The IMF recent report that the global economy debt pile is $164 trillion, and 225% of global GDP, now concentrated in nonfinancial corporations and governments. Rasmus explains how the ‘dual track’ Trump trade war (real for China and phony for US allies) will further impact US deficits, debt, and the economy.

1,981 Listeners

920 Listeners

119 Listeners

1,195 Listeners

1,481 Listeners

602 Listeners

254 Listeners

16,982 Listeners

149 Listeners

885 Listeners

1,181 Listeners

301 Listeners

39 Listeners

333 Listeners

64 Listeners