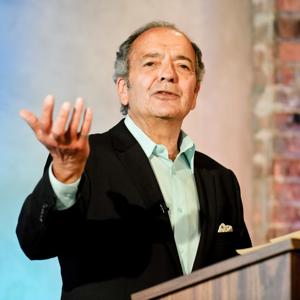

Dr. Jack Rasmus dissects the latest report on US economic growth for

first quarter 2016, showing a mere 0.5% annual GDP growth rate. The

collapse confirms his prediction of early January 2016, and confirms the

US economy remains on a ‘stop-go’ trajectory, having again slipped into

a ‘stall speed’ that raises risks of US sliding into recession. Rasmus

explains the longer term trends behind the 0.5%, and why the US 0.5%

annual growth rate, when compared to the previous quarter, is an even

lower 0.1% GDP or less. Averaging over 8+ years, the US economy has

grown only 10.1%, or barely 1%, or even less per year after adjustments.

Jack explains how the US and other countries have been redefining GDP

to help the appearance of growth—including China, India and Europe as

well as US. The more fundamental trends behind 1st quarter

US GDP are then reviewed--including business investment, industrial

production, exports, consumption, and prices, all of which suggest the

US economy nearing the brink of another recession. Why the US economy

keeps ‘relapsing’ periodically since 2009 is discussed, as well as the

likely impact of the 1st quarter US slowdown on other global economies and markets. (For more information, listeners should read Jack’s recent Telesur media article on US GDP posted on the PRN network website—‘Is the US Economy Heading for Recession?’)

View all episodes

View all episodes

By Progressive Radio Network

By Progressive Radio Network