Sign up to save your podcasts

Or

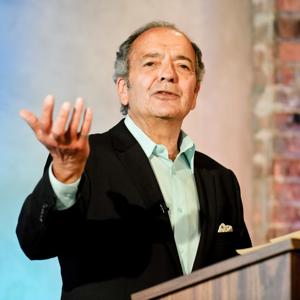

Dr. Rasmus goes in depth on the bitcoin mania and the bubble now at more than $15,000 a coin—a 1500% increase in speculative profits in 2017…and rising. What are the determinants and drivers of the Bitcoin mania, the ‘digital tulips’ bubble of today? Rasmus discusses the fundamental causes as blockchain technology and central bankers’ decades of massive liquidity injection into the global economy, looking desperately for ‘yield’, with inflows to digital currencies absorbing more and more. Additional ‘enabling’ factors have been driving prices as well, including proliferating ICOs, entry of traditional investor-speculators, diversion of financing from gold futures, and most important, increasing legitimation of Bitcoin and crypto currencies by established commodity clearing houses in the US (CME, CBOE), some countries’ endorsement (Japan), hedge funds preparation to enter the market, and even commercial banks (Chase) announcing partial participation. Bitcoin is a commodity, not yet a currency, and a speculative ‘play’ not unlike oil futures, gold futures (as were tulips ini 17th century Holland). Rasmus concludes with a discussion of government regulation, taxation, and potential channels of contagion to other financial asset markets (also approaching bubble territory) when the Bitcoin and cryptos price busts occur. Capital gains from Bitcoin commodity speculation at 1500% contrasts sharply with today’s just announced real wage gains of only 0.5% in the US. (Next week: the House-Senate final Trump Tax Cuts and latest acceleration of income inequality)

View all episodes

View all episodes

By Progressive Radio Network

By Progressive Radio Network

4.8

2525 ratings

Dr. Rasmus goes in depth on the bitcoin mania and the bubble now at more than $15,000 a coin—a 1500% increase in speculative profits in 2017…and rising. What are the determinants and drivers of the Bitcoin mania, the ‘digital tulips’ bubble of today? Rasmus discusses the fundamental causes as blockchain technology and central bankers’ decades of massive liquidity injection into the global economy, looking desperately for ‘yield’, with inflows to digital currencies absorbing more and more. Additional ‘enabling’ factors have been driving prices as well, including proliferating ICOs, entry of traditional investor-speculators, diversion of financing from gold futures, and most important, increasing legitimation of Bitcoin and crypto currencies by established commodity clearing houses in the US (CME, CBOE), some countries’ endorsement (Japan), hedge funds preparation to enter the market, and even commercial banks (Chase) announcing partial participation. Bitcoin is a commodity, not yet a currency, and a speculative ‘play’ not unlike oil futures, gold futures (as were tulips ini 17th century Holland). Rasmus concludes with a discussion of government regulation, taxation, and potential channels of contagion to other financial asset markets (also approaching bubble territory) when the Bitcoin and cryptos price busts occur. Capital gains from Bitcoin commodity speculation at 1500% contrasts sharply with today’s just announced real wage gains of only 0.5% in the US. (Next week: the House-Senate final Trump Tax Cuts and latest acceleration of income inequality)

1,979 Listeners

910 Listeners

117 Listeners

1,194 Listeners

1,481 Listeners

595 Listeners

251 Listeners

17,036 Listeners

150 Listeners

886 Listeners

1,176 Listeners

300 Listeners

36 Listeners

332 Listeners

62 Listeners