Last month the Bank of Japan (BoJ) expanded its QE program and negative

interest rates (NIRP) in a desperate attempt to reboost its stock market

and Yen exchange rate. This past week the European Central Bank

(ECB)went a step further, as both the ECB and BoJ continue to engage in

‘dueling QEs’ that are intensifying global currency wars and slowing

global trade. ECB chairman, Mario Draghi, lowered the Eurozone’s

negative rate on government bonds another notch, now to -0.4%.

Reportedly half of all government bonds in Europe now trade at negative

rates. In addition, the ECB raised its monthly buying amount from $66

billion to $88 billion, and now will buy corporate bonds as well. The

move subsidizes Euro corporations, lowering their costs of borrowing and

insurance (CDS) on bonds, a move to offload the $1.5 trillion in

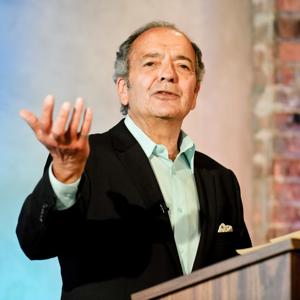

corporate non-performing loans in Europe. Jack Rasmus explains why this

won’t have any effect on the Eurozone real economy but will temporary

boost stocks and currency. Jack also reviews why global oil prices have

risen recently to $40 a barrel, Japan’s official return to recession

after doctoring GDP numbers last 3Q2015, China’s latest

‘mini-stimulus’, the US deepening control of Ukraine’s economy, and the

significance of the ‘Socialist’ government in France new attack on

eliminating the 35 hr. workweek, where 90% of all jobs created in 2015

were part time and temp, and the mass protests now emerging there. Jack

concludes with brief introduction to his forthcoming May 2016 book,

‘Looting Greece: The Emergence of a New Imperialism’, and his next book

out October 2016 entitled, ‘Central Bankers on the Ropes’, both from

Clarity Press. (see his blog, jackrasmus.com and Clarity Press for more

information).

View all episodes

View all episodes

By Progressive Radio Network

By Progressive Radio Network