Sign up to save your podcasts

Or

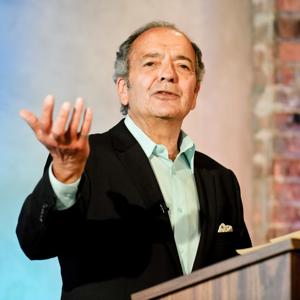

Dr. Rasmus dissects the Trump tax proposal of this past week, crafted by Goldman Sachs investment bankers, Steve Mnuchin (Treasury Secretary) and Gary Cohn (head of economic council). Rasmus explains how it is the latest in a long line of neoliberal tax proposals since 1981, which are designed to shift income to businesses, investors and wealthy households at the expense of wage earners. Once again wealthy investors, households, corporations and non-corporate businesses all gain at the expense of wage earners with annual incomes of $38 to $91,000. Rasmus explains how tax cuts are a foundation of neoliberal policy--along with defense-war spending hikes, social program cuts, and the ‘twin deficits’ solution to financing government debt. Tax cutting from Reagan to Obama to Trump are summarized. The major elements of corporate and non-corporate business income that will benefit from the Trump plan are summarized, including benefits that will accrue to the wealthiest households and businesses as a result of the elimination of estate and AMT taxes, retention of carried interest and preferential capital gains, new cuts in top end corporate and personal nominal tax rates, Trump’s proposal to end the territorial taxation, to allow multinational corps to repatriation $2.6 trillion at special rates, big cuts in business income pass through, etc . (Next week: Financial Asset Bubbles Again Growing—What Could Happen).

View all episodes

View all episodes

By Progressive Radio Network

By Progressive Radio Network

4.8

2525 ratings

Dr. Rasmus dissects the Trump tax proposal of this past week, crafted by Goldman Sachs investment bankers, Steve Mnuchin (Treasury Secretary) and Gary Cohn (head of economic council). Rasmus explains how it is the latest in a long line of neoliberal tax proposals since 1981, which are designed to shift income to businesses, investors and wealthy households at the expense of wage earners. Once again wealthy investors, households, corporations and non-corporate businesses all gain at the expense of wage earners with annual incomes of $38 to $91,000. Rasmus explains how tax cuts are a foundation of neoliberal policy--along with defense-war spending hikes, social program cuts, and the ‘twin deficits’ solution to financing government debt. Tax cutting from Reagan to Obama to Trump are summarized. The major elements of corporate and non-corporate business income that will benefit from the Trump plan are summarized, including benefits that will accrue to the wealthiest households and businesses as a result of the elimination of estate and AMT taxes, retention of carried interest and preferential capital gains, new cuts in top end corporate and personal nominal tax rates, Trump’s proposal to end the territorial taxation, to allow multinational corps to repatriation $2.6 trillion at special rates, big cuts in business income pass through, etc . (Next week: Financial Asset Bubbles Again Growing—What Could Happen).

1,979 Listeners

919 Listeners

119 Listeners

1,193 Listeners

1,482 Listeners

602 Listeners

250 Listeners

17,000 Listeners

150 Listeners

886 Listeners

1,181 Listeners

300 Listeners

40 Listeners

331 Listeners

63 Listeners